The most recent CFTC Positioning Report for the week ending July 15 shows that the US Dollar (USD) maintained its gradual recovery. This comes in response to further data reinforcing the resilience of the US economy along with a pick-up in the trade effervescence, with the epicentre in the still elusive US-EU trade agreement. Additionally, ongoing concerns about the Trump-Powell conflict contributed to the upward momentum of the Greenback.

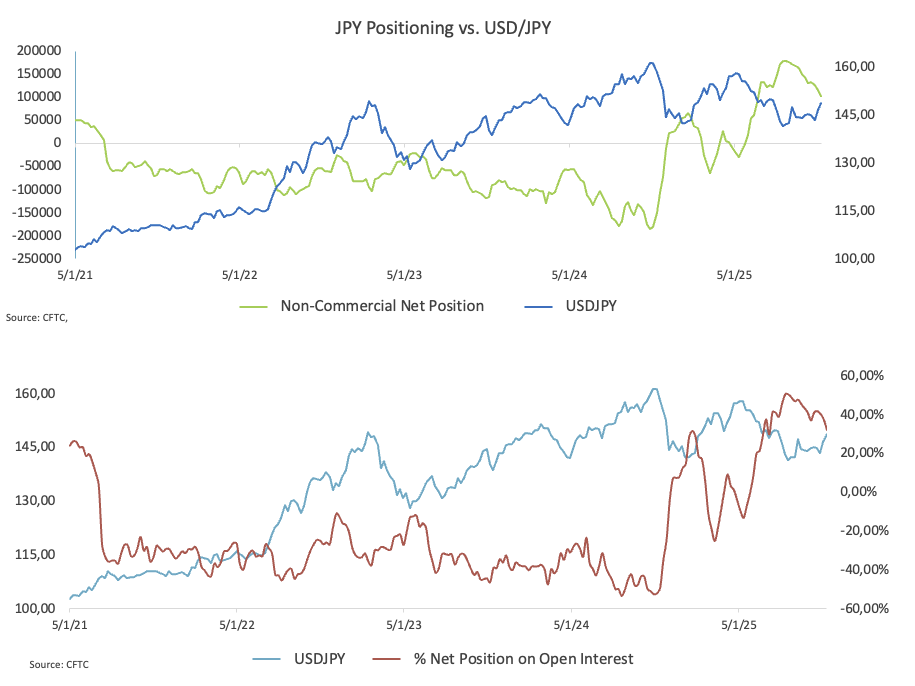

Non-commercial players have lowered their net long holdings in the Japanese Yen (JPY) to around 103.6K contracts, matching levels last seen in late February. Institutional traders have cut their bearish bets to around 110.9K contracts, or multi-month lows, all amid open interest rising slightly to about 321.3K contracts. In the meantime, USD/JPY extended its upward momentum and rose sharply, approaching the 149.00 level, or three-month highs.

Speculators trimmed their net shorts in the US Dollar (USD) to their lowest level in four weeks at around 3.7K contracts. This drop coincided with a slight increase in open interest, which is currently about 35.2K contracts. The US Dollar Index (DXY) has extended its gradual recovery, breaking above the 98.00 barrier and beyond, reaching three-week highs at the same time.

Speculative net longs in the Euro (EUR) have gone up to above 120.5K contracts, the highest level since December 2023. Commercial players, in addition, have increased their net shorts to over 177K contracts, which is the highest level in a few months. Open interest has also gone up for the fourth week in a row, this time to just over 820K contracts, the most since March 2023. EUR/USD extended its monthly decline, putting the support level at 1.1600 the figure to the test.

Non-commercial net longs in the British Pound (GBP) have dropped to levels last seen in late May, around 29.2K contracts. Simultaneously, open interest has slowed down, reaching its lowest level in four weeks around 187.3K contracts. The US Dollar became stronger, while the UK’s fiscal and economic worries stayed the same, putting further pressure on the British Pound and dragging GBP/USD to fresh two-month lows below the 1.3400 yardstick.

Speculative net longs in Gold have risen to approximately 213.1K contracts, marking the highest level since early April. Open interest, on the other hand, has reached three-month highs of around 448.5K contracts. Gold prices stayed in the multi-week range of approximately $3,330 per troy ounce, as they were constantly keenly watching what was happening in trade, geopolitics, and speculation about the Fed’s rate path.

Speculators have lowered their net longs in WTI to around 162.4K contracts, which is the lowest level since October 2024. At the same time, open interest has reached its highest level in five weeks, totalling approximately 2.07 million contracts. The commodity’s performance was inconsistent during that period, with its important 200-day SMA around the $68.00 mark per barrel limiting advances. Trade, geopolitics, and OPEC+’s intentions to increase oil production in the next several months will primarily determine what happens to crude oil prices.