- The Pound Sterling booked its third consecutive weekly gain against the US Dollar.

- GBP/USD will likely follow the latter’s price action and tariff talks in the US Nonfarm Payrolls week.

- The path of least resistance appears to be upward for the pair, per the daily technical setup.

The Pound Sterling (GBP) extended its winning momentum against the US Dollar (USD), driving the GBP/USD pair briefly to levels above 1.3400.

Pound Sterling hit the highest level in seven months

GBP/USD mainly remained at the mercy of the US Dollar dynamics, induced by US President Donald Trump’s erratic tariff moves and some flickers of optimism on surprisingly resilient US corporate earnings.

The Greenback yo-yoed wildly this week, tumbling nearly 1% against its major rivals at the start of the week on Monday after Trump threatened to fire Fed Chair Jerome Powell for not lowering interest rates quickly enough, only to surge 1.5% a day later as Trump softened his rhetoric about China and the independence of the US Federal Reserve.

On Wednesday, US Treasury Secretary Scott Bessent said that high tariffs between the US and China are not sustainable, signalling openness to de-escalating a trade war between the world’s two largest economies. The Trump administration also noted that lower-level trade talks were already underway.

In response to the reports about talks between China and the US, a Chinese Foreign Ministry spokesperson said on Thursday they have not held consultations or negotiations on tariffs. A China’s Commerce Ministry spokesman said that the US should lift all unilateral tariffs against China if it “truly” wanted a resolution.

A lack of actual progress towards opening talks with Beijing, though, had the US Dollar drooping again later in the week. However, the US currency regained upside traction on Friday as the recession fears receded, and there was trade deal optimism between the US and its Asian allies, China, South Korea, and Japan.

On Thursday, Seoul’s delegation said both sides aim to craft a trade package before the pause on reciprocal tariffs is lifted in July. Meanwhile, Japanese Finance Minister Kato Katsunobu held talks with US Treasury Secretary Scott Bessent in Washington on Thursday, noting that Bessent did not raise the Yen’s level in bilateral talks.

The US Dollar built on its rebound after a Bloomberg report cited sources stating that the “Chinese government is considering suspending its 125% tariff on some US imports, as the economic costs of the tit-for-tat trade war weigh heavily on certain industries.”

Data published by the Office for National Statistics (ONS) showed Friday that British Retail Sales rose unexpectedly in March by 0.4% month-over-month (MoM), outstripping the anticipated 0.4% decline. The data failed to provide any impetus to the Pound Sterling as economic releases continued to be ignored by markets.

Meanwhile, several Bank of England (BoE) and Fed officials spoke during the week, citing prudence on revising the policy, as they continue to assess the impact of Trump’s tariffs on the economy and inflation prospects. Speaking in a CNBC interview on Thursday, BoE Governor Andrew Bailey said that they see the effect of tariff uncertainty coming through to business investment and consumers.

Trade talks will continue to lead way

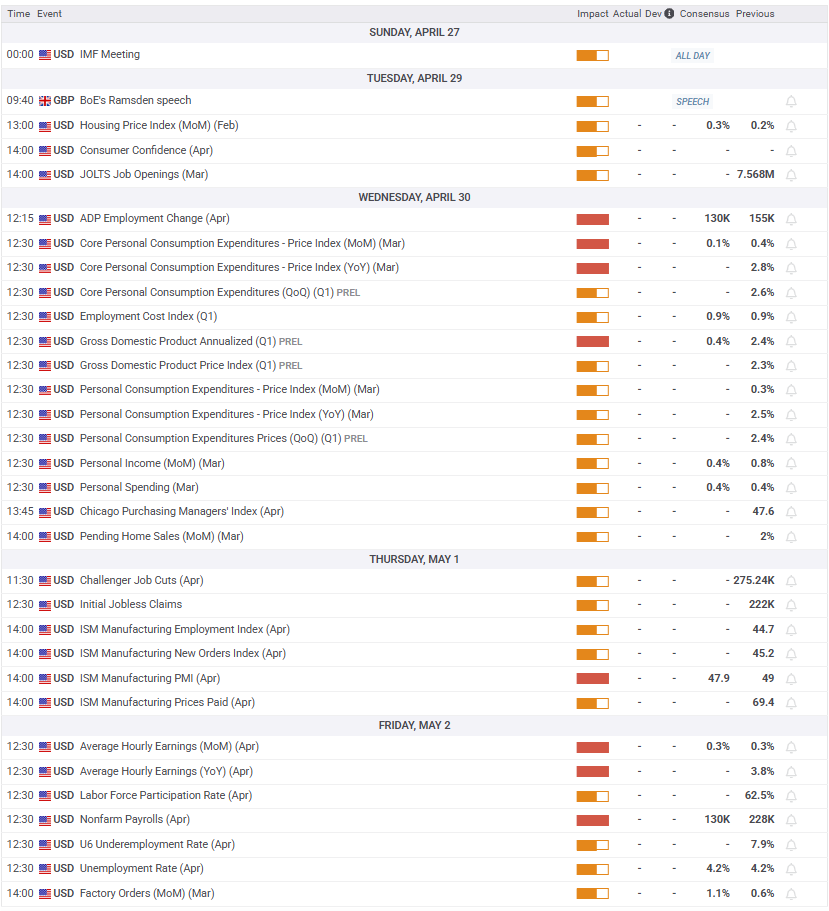

Once again, tariff talks concerning the United States (US) and its major global trading partners, including China, will continue to overshadow a bunch of top-tier US employment data in the week ahead.

The US JOLTS Job Openings data will be published on Tuesday ahead of Wednesday’s ADP Employment Change data and the all-important Nonfarm Payrolls (NFP) report on Friday.

However, the advance first-quarter Gross Domestic Product (GDP) data from the US could steal the spotlight as investors remain wary about the impact of US President Donald Trump’s protectionist policies on the economy.

The data could trigger a big market reaction, with intense volatility likely to be seen around the US Dollar trades. Therefore, GBP/USD traders should be cautious when heading into the US GDP showdown midweek.

Other data releases, including the US ISM Manufacturing and Services PMIs, will continue to play second fiddle to trade headlines.

Meanwhile, the UK economic calendar lacks any high-impact data publication while the Fed enters its ‘blackout period’ on Saturday ahead of the May 6-7 monetary policy meeting.

GBP/USD: Technical Outlook

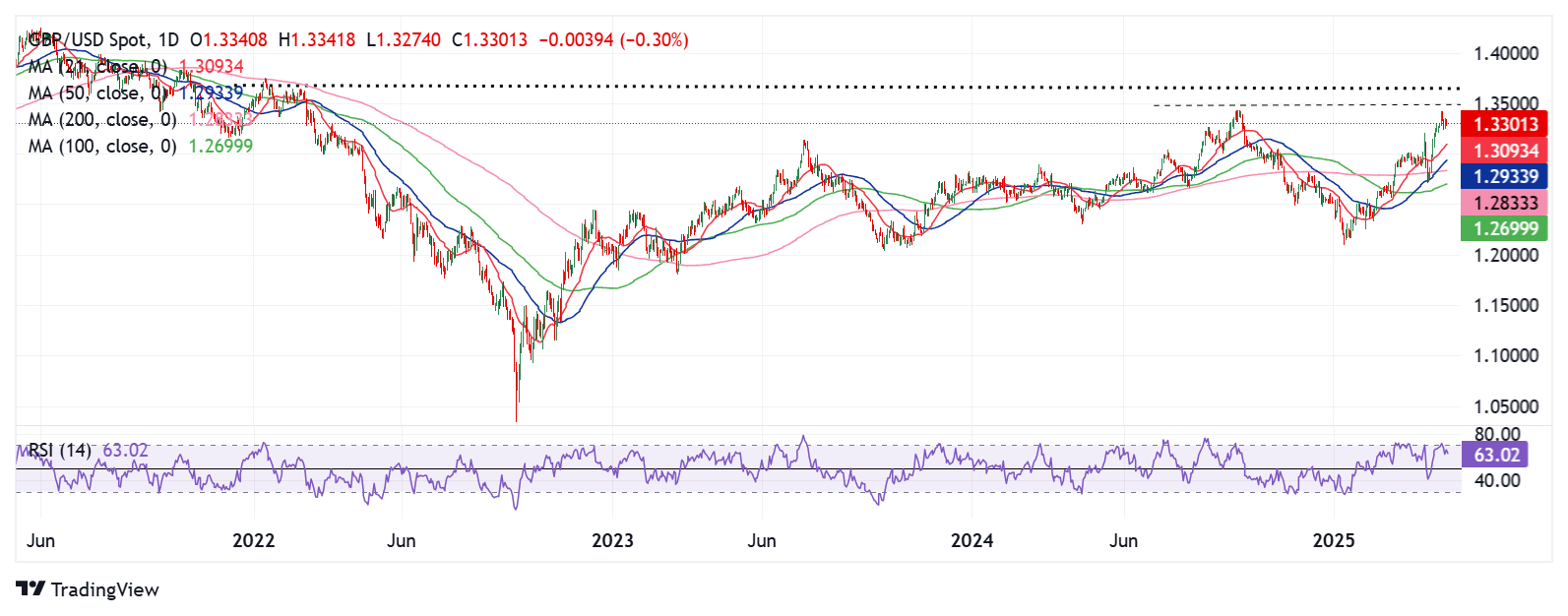

Following the confirmation of a Golden Cross on April 17, GBP/USD extended its bullish momentum and hit the highest level in seven months at 1.3424.

The 50-day Simple Moving Average (SMA) crossed above the 200-day SMA on a daily closing basis, indicating a potential upward trend.

However, overbought conditions on the 14-day Relative Strength Index (RSI) fuelled a moderate correction in the pair to near the 1.3240 level before buyers quickly jumped in.

At press time, the RSI, a leading indicator, holds within the positive territory, near 62, suggesting that the bullish bias will likely extend in the week ahead.

The pair must close the week above the critical confluence resistance range of 1.3425-1.3445 to stretch higher toward the 1.3500 barrier.

Should buying momentum intensify above that level, a test of the February 2022 high of 1.3644 will be inevitable.

Conversely, if the pair witnesses a corrective downside, the 1.3200 round level will be tested initially, below which the doors will open toward the 21-day SMA at 1.3093.

A sustained break below the 21-day SMA will target the 50-day SMA at 1.2934.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.