- Gold weakens as risk sentiment improves, US equities rally pushing S&P 500 futures to record highs.

- Core PCE inflation for May rises along with June Michigan Consumer Sentiment Index while inflation expectations fall.

- XAU/USD remains on the backfoot with selling pressure increasing below $3,300.

Gold (XAU/USD) is on the defensive heading into the weekend, pressured by a combination of mixed US data and improving global risk sentiment.

The precious metal is trading below $3,300, down nearly 2% on the day, as safe-haven flows continue to unwind.

Friday’s core PCE inflation print showed a modest uptick in May, reinforcing the Fed’s cautious stance and creating a murkier outlook for the timing of rate cuts. Meanwhile, the University of Michigan Consumer Sentiment Index ticked higher in June, while inflation expectations softened, pointing to stable consumer outlooks.

US inflation data for May rises above analyst estimates

The release of the core Personal Consumption Expenditure (PCE) on Friday has placed additional pressure on the US Dollar but did little to boost Gold.

This important dataset measures the pace at which prices of goods and services are rising and is released on a monthly basis. It is the Federal Reserve’s (Fed)preferred measure of inflation, which plays a significant role in setting expectations for interest rates.

The headline PCE inflation figures for May came in line with expectations. The monthly figure rose by 0.1%, unchanged from April, while the year-over-year rate increased to 2.3%, slightly above April’s 2.2%, and in line with forecasts.

However, the core PCE data—which excludes volatile components such as food and energy—surprised to the upside. Both the monthly and annual figures came in hotter than expected. Core PCE rose 0.2% month-over-month, ahead of the 0.1% estimate, while the annual rate climbed to 2.7%, surpassing expectations for an unchanged reading from April’s 2.6%.

In contrast, broader consumption data disappointed. Personal income fell by 0.4% in May, well below the expected 0.3% increase and a sharp reversal from April’s 0.7% gain. Personal spending also declined by 0.1%, missing the consensus forecast for a 0.1% rise and down from the prior month’s 0.2%.

As the Federal Reserve’s preferred measure of inflation, the rise in core PCE complicates the policy outlook. President Donald Trump continues to pressure the Fed to cut interest rates to support growth, but such action typically fuels inflation—already above the central bank’s 2% target.

Still, with income and spending data showing clear signs of economic fatigue, the Fed may be forced to weigh inflation against the risk of a broader slowdown. For markets, this opens the door to a dovish shift in tone, potentially paving the way for a rate cut as early as July.

Moreover, President Trump is putting immense pressure on the Fed to cut rates to stimulate the economy.

A major concern for the Fed has been the impact of tariffs on inflation. A trade deal with China, which has resulted in a pause of higher reciprocal tariffs on Chinese imports until August 12, could alleviate some of the pressure that potential higher tariffs may have on the US economy. According to the CME FedWatch Tool, the probability of a 25-basis point (bps) rate cut in September has increased to 72%, with markets anticipating rates to fall by at least 50 bps by year-end.

While lower rates bode well for Gold, the increase in demand for equities and riskier assets may continue to weigh on bullion in the short term.

Daily digest market movers: Gold digests the release of key US economic data as safe-haven demand fades

- The latest University of Michigan data painted a mixed picture of consumer sentiment and inflation expectations in the United States. The Consumer Sentiment Index rose slightly to 60.7 in June, up from 60.5 previously, suggesting a modest improvement in overall consumer confidence.

- However, the Consumer Expectations Index slipped to 58.1, indicating that households are feeling slightly less optimistic about future economic conditions.

- On the inflation front, both short- and long-term expectations edged lower, with the one-year outlook falling to 5.0% and the five-year figure easing to 4.0%. While inflation expectations remain elevated, the decline could offer some relief to the Federal Reserve as it navigates conflicting signals—resilient inflation data alongside slowing consumer demand.

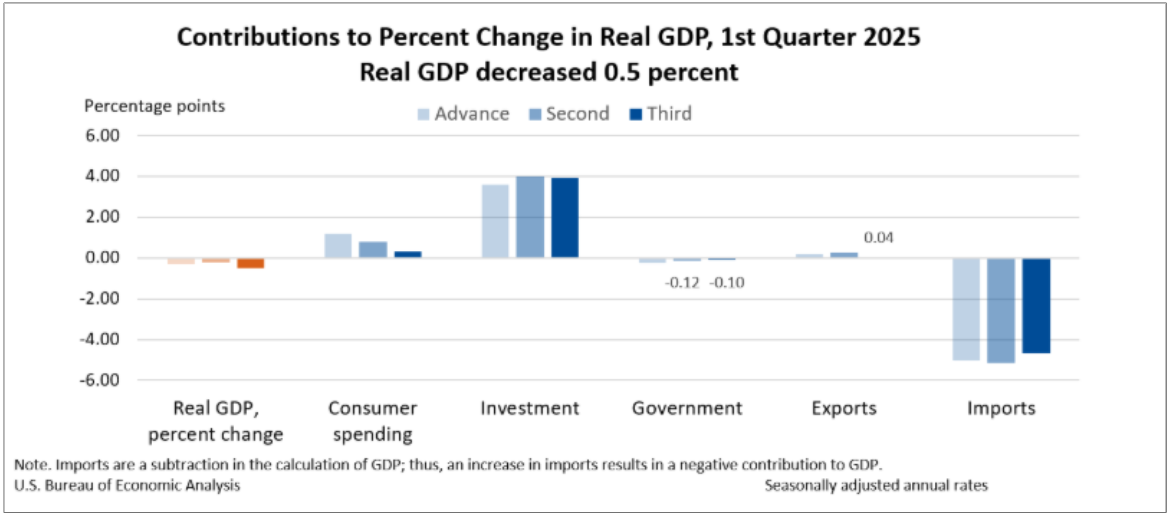

- Thursday’s final Gross Domestic Product (GDP) reading for the first quarter showed that the US economy had contracted by 0.5%, as imports increased before the imposition of the higher tariff rates announced by Trump on “Liberation Day.”

- The table below illustrates the breakdown of the Q1 GDP components released by the US Bureau of Economic Analysis on Thursday.

- The Bank Stress Test, published by the Federal Reserve’s Board of Governors, will be released at 20:30 GMT. This report outlines how the largest US banking institutions would perform under various adverse economic scenarios. It is designed to evaluate the resilience of the financial system; the test assesses how these banks would respond to severe financial shocks.

- The results can influence the Federal Reserve’s monetary policy outlook and help gauge potential risks to its long-term goals of price stability and sustainable economic growth.

- For Gold, the culmination of these data releases may play an important role in determining the direction of XAU/USD. Especially once the latest US-China progress on trade talks has been digested by markets, investors focus on the broader macroeconomic environment.

Gold technical analysis: XAU/USD extends losses as bearish momentum pushes the RSI toward oversold terriitory

Gold remains under pressure, with prices trading below the key psychological level of $3,300, which now provides near-term resistance for the yellow metal.

Above that is the 50-day Simple Moving Average at $3,324 and the 20-day SMA near $3,356.

The Relative Strength Index (RSI) is nearing 30, a potential sign of oversold conditions.

In the bearish scenario, a sustained break below the mid-point of the April low-high move, represented by the 50% Fibonacci retracement level, provides support at $3,228. A break of which could open the door toward the $3,200 psychological handle. The 100-day SMA at $3,164 acts as a deeper support level.

Gold daily chart

On the other hand, the bullish scenario would require a decisive recovery above the 20-day SMA, potentially reigniting upside momentum toward the $3,400 and $3,452 resistance levels. Until such a move materializes, Gold may remain vulnerable to deeper retracements within its broader consolidation pattern.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.