- Trade war tensions have boosted EURUSD.

- Verbal interventions have not cooled USDJPY.

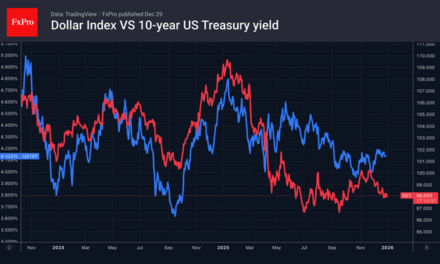

Donald Trump’s threat of tariffs from February 1st is a political gamble that is hurting the dollar. In the coming days, the Supreme Court may cancel universal import duties, so the White House will not be able to introduce new ones with the same ease as before. However, the US president’s real goal may not be Greenland at all, but rather to increase the competitiveness of American companies through a weaker currency.

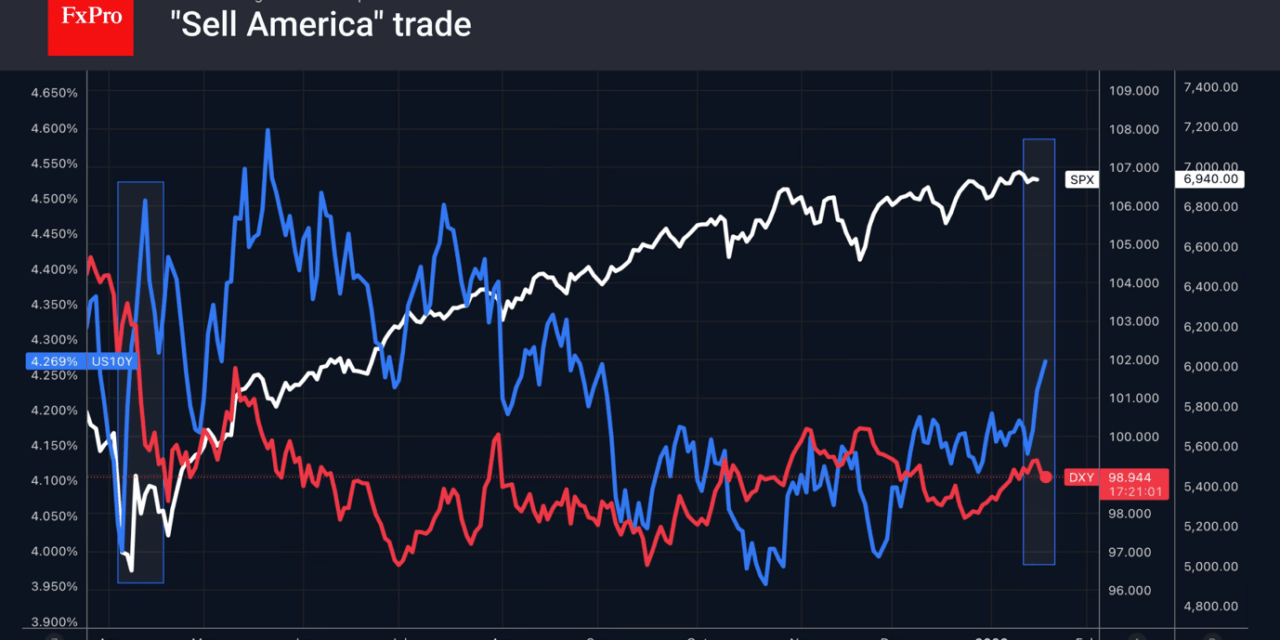

The markets have studied Donald Trump well and are accustomed to his strategy of maximum threats followed by retreat after some goals are achieved. Or, if the counterparty is ready and has cards in hands to escalate, as was the case with China in 2025. Investors are using the April template. At that time, the EURUSD rose after the introduction of large-scale US tariffs amid renewed ‘sell America’ trade.

Additional pressure on the dollar is being created by the court case concerning the dismissal of Lisa Cook. The White House has a better chance of winning this case than it did with the Supreme Court case on the legality of tariffs. The removal of a FOMC member could set a precedent and give the president free rein to fill the Committee with policy doves.

The euro is rising despite Goldman Sachs’ pessimistic scenario. According to the bank’s estimates, a 10% tariff will reduce the eurozone’s real GDP by 0.1-0.2%. Germany will suffer the most, with its gross domestic product falling by 0.3% if 25% import tariffs are introduced. However, investors are seriously counting on new fiscal stimuli to support the economy in the event of a large-scale trade war.

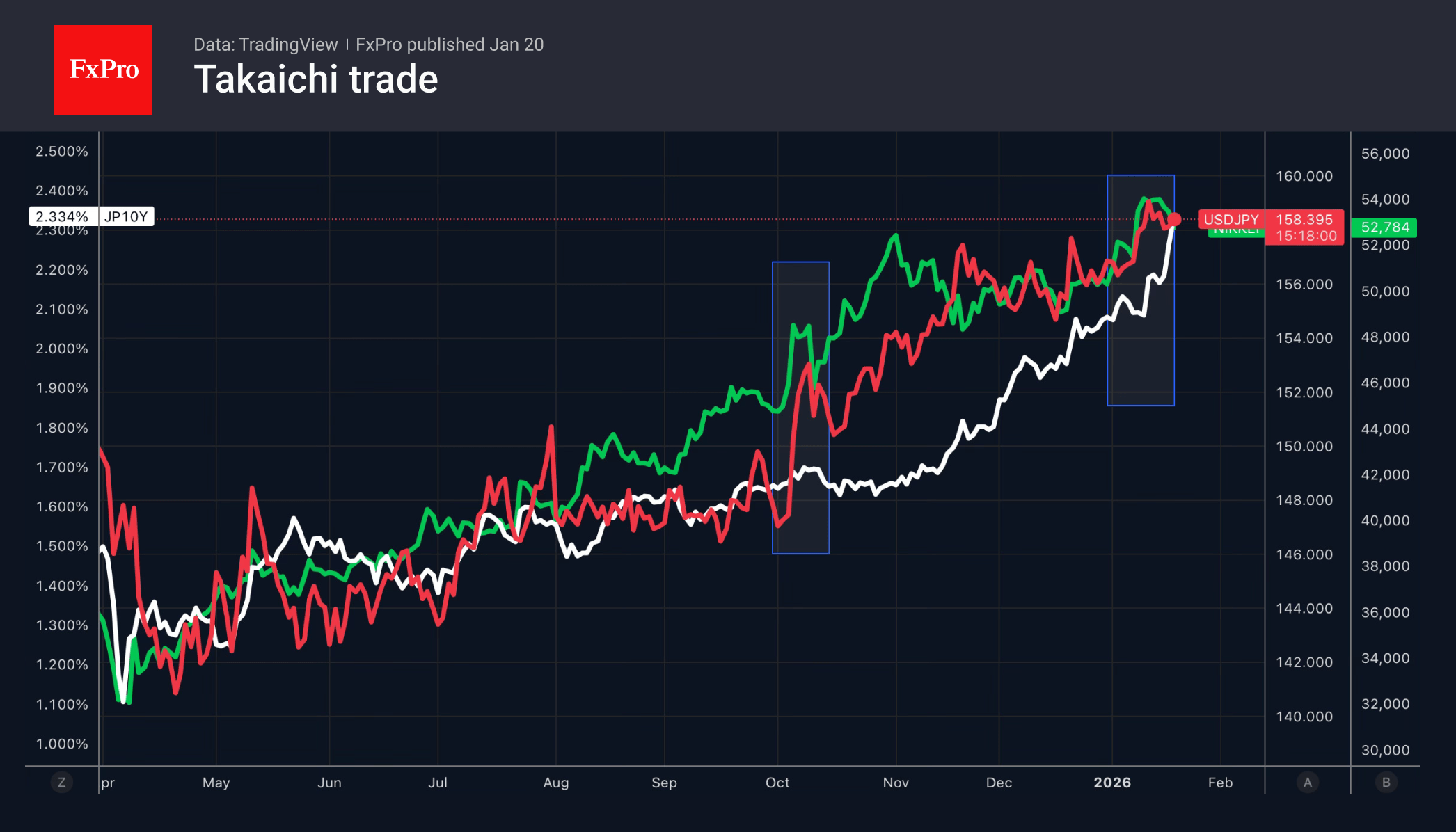

The weakening of the US dollar and verbal interventions only temporarily helped the bears on USDJPY. Japanese Finance Minister Satsuki Katayama said that the agreement with Washington justifies currency intervention. The government intends to take decisive measures against speculative movements in the Forex market.

Nevertheless, the yen’s position looks vulnerable as the Takaitchi trade flourishes ahead of the parliamentary elections. Within its framework, Japanese stocks are being actively bought, while bonds and the Japanese currency are being sold.

Due to the growing risks of a trade war between the US and Europe and threats to the independence of the Federal Reserve, gold exceeded $4,700 per ounce for the first time in history. However, the Supreme Court’s cancellation of tariffs may dampen the mood of precious metal enthusiasts.

The FxPro Analyst Team