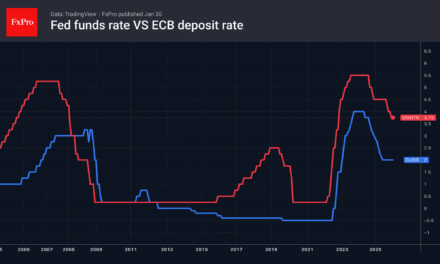

Both the Federal Reserve (2 PM ET) and the Bank of Canada (9:45 AM ET) will announce interest rate decisions today, with no changes expected from either.

Markets will be watching the Fed especially closely for signs of a shift in tone. While the policy rate is likely to remain unchanged, the decision could be split—raising questions about whether Chair Powell and the board are starting to lean toward a September rate cut.

Fed Governors Bowman and Waller have already signaled openness to easing. Will others follow suit? Will Powell lean into the dovish shift? Today’s statement and press conference may offer the clearest clues yet.

In the video above, I break down the technical outlook for the three major currency pairs: EURUSD, GBPUSD, and USDJPY.

-

EURUSD fell sharply on Monday following the EU–US trade agreement. The decline extended into Tuesday before rebounding late in the day. After an early attempt to move higher, the pair rotated lower again and is now testing the lows as the North American session begins.

-

GBPUSD dipped early Tuesday but recovered toward Monday’s closing level. It shows a slight upward bias today, though it slipped modestly heading into the U.S. session and is currently trading marginally higher.

-

USDJPY dropped during the European morning but has since rebounded into positive territory.

I cover the key technical levels and setups for each pair in the video above

European GDP data was mixed overall—with France beating expectations, Germany in line, and Italy missing. Broader economic figures from Europe and Switzerland mostly beat forecasts, showing modest resilience in consumer activity and sentiment.

Here’s a summary of the economic data released in Europe this morning

-

French Consumer Spending m/m: 0.6% vs -0.3% forecast, 0.1% previous → BEAT

-

French Flash GDP q/q: 0.3% vs 0.1% forecast, 0.1% previous → BEAT

-

German Retail Sales m/m: 1.0% vs 0.5% forecast, -0.6% previous → BEAT

-

Swiss KOF Economic Barometer: 101.1 vs 97.9 forecast, 96.3 previous → BEAT

-

Spanish Flash CPI y/y: 2.7% vs 2.3% forecast, 2.3% previous → HIGHER INFLATION

-

German Prelim GDP q/q: -0.1% vs -0.1% forecast, 0.4% previous → MET

-

Italian Prelim GDP q/q: -0.1% vs 0.1% forecast, 0.3% previous → MISSED

-

EU Flash GDP q/q: 0.1% vs 0.0% forecast, 0.6% previous → BEAT

Australian data was mixed: retail sales beat expectations, while building approvals slowed more than forecast—signaling resilience in consumer demand but weakness in housing.

Here’s the breakdown:

-

Retail Sales m/m: 0.4% vs 0.2% forecast, 0.2% previous → BEAT

-

Building Approvals m/m: 1.8% vs 3.2% previous (no forecast shown, but lower than prior) → SLOWED

On the earning front today, the fireworks will occur after the close when Microsoft and Meta announce earnings. In the premarket the following announced:

-

Kraft Heinz (KHC) Q2 2025:

EPS $0.69 (BEAT; exp. $0.64), Revenue $6.35B (BEAT; exp. $6.25B) -

Automatic Data Processing (ADP) Q4 2025:

EPS $2.26 (BEAT; exp. $2.23), Revenue $5.13B (BEAT; exp. $5.04B), EBIT $1.28B (no est. provided)

-

Hershey (HSY) Q2 2025:

EPS $1.21 (BEAT; exp. $0.98), Revenue $2.615B (BEAT; exp. $2.52B)

-

GE Healthcare (GEHC) Q2 2025:

EPS $1.06 (BEAT; exp. $0.92), Revenue $4.963B (MISS; exp. $4.96B) (rounding suggests a tiny beat or match depending on source) -

Trane Technologies (TT) Q2 2025:

EPS $3.88 (BEAT; exp. $3.78), Revenue $5.75B (MET; exp. $5.77B) -

Humana (HUM) Q2 2025:

EPS $6.27 (BEAT; exp. $5.71), Revenue $32.4B (BEAT; exp. $31.88B)

After the close the following companies reported:

-

Electronic Arts (EA) Q1 2026: EPS $0.79 (BEAT; exp. $0.10), Revenue $1.671B (BEAT; exp. $1.24B). Shares are trading up 1.83% in premarket trading

-

Visa (V) Q3 2025: EPS $2.98 (BEAT; exp. $2.85), Revenue $10.2B (BEAT; exp. $9.84B). Shares are trading down -2.36%

-

Seagate Technology (STX) Q4 2025: EPS $2.59 (BEAT; exp. $2.42), Revenue $2.44B (BEAT; exp. $2.41B). Shares are trading down -7.0% in premarket trading

-

Starbucks (SBUX) Q3 2025: EPS $0.50 (MISS; exp. $0.64), Revenue $9.5B (BEAT; exp. $9.31B). Shares are trading up 5.63%.

-

Booking Holdings (BKNG) Q2 2025: EPS $55.40 (BEAT; exp. $49.88), Revenue $6.8B (BEAT; exp. $6.54B).. Shares are trading down 1.97% premarket

Pres. Trump this morning said that the August 1 deadline stands strong and will not be extended. With that backdrop, he says that India will be paying a tariff of 25% plus a penalty. He says that their tariffs are far too high – among the highest in the world – and they have the most strenuous and obnoxious trade barriers of any country. The president also cited that India buys a lot of goods from Russian including military, and China. Those things are not in favor of the President..

In addition to the rate decisions, the US GDP will be released at 8:30 AM with expectations of 2.4% versus -0.5% last quarter. The Atlanta Fed estimates 2.8%.

US stocks are trading higher:

- Dow industrial average up 17 points

- S&P index up 7.39 points

- NASDAQ index 43 points

in the US debt market, yields are marginally higher:

- 2-year yield 3.879%, +0.4 basis points

- 5-year yield 3.916%, +1.2 basis points

- 10 year yield 4.340%, +1.2 basis points

- 30 year yield 4.81%, +1.4 basis points

The ADP employment report just released came in higher than expected at 104K versus 75K

This article was written by Greg Michalowski at investinglive.com.

Source link