The PPI data let the cat out of the bag.

If tariffs collected are filling the US treasury with $29B per month, that implies a price increase.

- Does the exporter eat the tariffs by cutting the cost of their goods into the US?

- Does the importer eat the costs at the expense of margins?

- Does the consumer pay the cost in the form of higher prices?

The CPI was relatively tame. The PPI was not. The cost is showing up in the producer prices. That makes sense.

CNBC Cramer is questioning the numbers, however, saying that the numbers are questionable, given anecdotal information. Cite warehouses cost are up and there are no people in warehouses. Of course it is one thing but as the economy changes, is the data not reflecting the efficiencies?

Regardless, the question is, “If there is increased costs, do those increased costs trickle down to the consumers?”

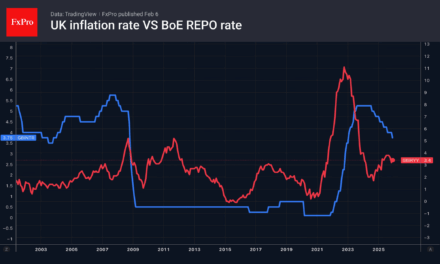

What we know is that Fed Powell has proof that inflation is moving higher from the data, and has the potential to move higher to the consumer. What we don’t know, however, is it now done? Or will it lead to a racheting up in prices, that begets a racheting up and begets an even more racheting up of prices and costs? The beliefs are not as the expectations are still for 56 basis points of cuts between now and the end of the year.

The USD has moved higher off the news:

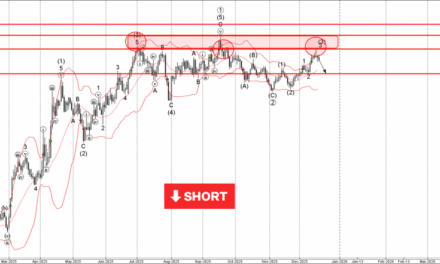

EURUSD: The EURUSD moved from 1.16807 to 1.1648. That took the price below is 100 hour MA and 61.8% at 1.16615. The price is trading right around the confluenced levels now. Watch that level for technical clues. ON the downside, the 200 hour MA comes in at 1.16339. Moving below it will add to the bearish bias.

USDJPY: The USDJPY was lower into the release after breaking below a confluence of technical levels between 147.05 to 147.135 (200 bar MA on the 4-hour, trend line and the 38.2% of the 2025 trading range). The price high has reached 147.095. So far, the sellers are leading.